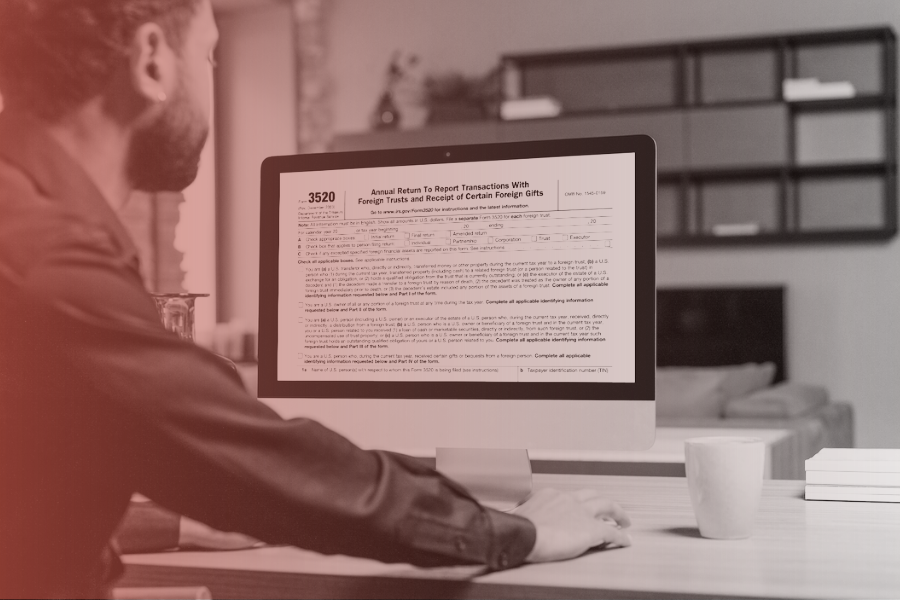

Learn who must report a foreign gift and what information to prepare

How Legal Provider Can Assist You in Coverage a Foreign Gift: Secret Facts and Insights

Guiding via the complexities of reporting international gifts can be daunting for companies and people alike. Legal services give necessary know-how in understanding the detailed guidelines that govern these deals. They aid determine prospective threats and develop tailored compliance approaches. Numerous still deal with obstacles in ensuring adherence to these requirements. This triggers the questions of just how reliable lawful guidance can really improve conformity and minimize threats connected with foreign gift reporting.

Understanding the Legal Framework Surrounding Foreign Gifts

While the acceptance of foreign gifts can improve worldwide relationships and foster cooperation, it also elevates complex lawful factors to consider that organizations have to navigate. The lawful structure regulating international presents includes numerous laws and laws, which can vary noticeably across territories. Institutions need to know rules worrying the disclosure, assessment, and potential tax of these gifts.

Furthermore, compliance with government guidelines, such as the Foreign Representatives Registration Act (FARA) and the College Act, is necessary for organizations receiving significant international contributions. These laws intend to assure transparency and avoid undue impact from foreign entities.

Additionally, establishments need to consider moral guidelines that control gift approval to maintain honesty and public count on. By recognizing these legal details, organizations can much better handle the threats connected with international gifts while leveraging the possibilities they present for international collaboration and collaboration.

Key Coverage Requirements for Individuals and Organizations

Organizations and people getting foreign presents should abide by particular coverage requirements to assure conformity with lawful responsibilities. These demands vary depending upon the territory and the nature of the present. Generally, receivers are mandated to disclose international presents going beyond a certain monetary threshold to appropriate federal government firms. This may include in-depth details concerning the donor, the value of the gift, and its designated usage.

In the USA, for instance, the Foreign Brokers Registration Act (FARA) and the College Act enforce distinct reporting criteria - report a foreign gift. Institutions need to ensure that their coverage aligns with appropriate regulations to avoid fines. People may additionally require to report presents obtained in their capacity as public authorities or employees

Recognizing these requirements is essential, as failure to report suitably can lead to legal repercussions. Subsequently, engaging lawful solutions can facilitate compliance and help navigate the complexities of foreign gift reporting.

Typical Compliance Obstacles and Just How to Get rid of Them

Navigating the complexities of foreign present reporting commonly offers substantial conformity obstacles for receivers. One typical problem is the obscurity bordering the meaning of a "international present," which can cause unpredictability about what needs to be reported (report a foreign gift). In addition, differing state and federal regulations can make complex adherence to reporting requirements, specifically for companies operating throughout territories. Recipients may also fight with keeping precise records, as failure to document presents appropriately can lead to non-compliance

To get over these obstacles, recipients should establish clear internal policies regarding international presents, making certain all personnel are educated on compliance demands. Normal audits of gift records can aid identify disparities early. Additionally, looking for advice from compliance specialists can provide clearness on subtleties in regulations. By proactively attending to these difficulties, recipients can much better browse the reporting process and decrease the threat of charges associated with non-compliance.

The Function of Legal Provider in Navigating Foreign Gift Laws

Steering through the elaborate landscape of international present regulations can be daunting, particularly given the possible legal implications of non-compliance (report a foreign gift). Legal solutions play a crucial function in leading individuals and companies through this complicated surface. They provide professional evaluation of the relevant guidelines, guaranteeing customers totally understand their obligations relating to international presents. Furthermore, attorneys help in recognizing possible threats and liabilities associated with non-disclosure or misreporting

Finest Practices for Ensuring Compliance With Foreign Present Reporting

Compliance with foreign gift coverage needs requires a proactive approach to prevent possible pitfalls. Organizations ought to develop a clear plan outlining the standards for identifying and reporting foreign gifts. Normal training for staff included in the approval of presents is necessary to ensure they recognize reporting obligations and the implications of non-compliance.

Furthermore, preserving in-depth documents of all international presents received, including the donor's worth, identity, and purpose, is important. Organizations needs to implement an evaluation procedure to examine whether a gift certifies as reportable.

Involving lawful solutions can further reinforce conformity efforts, providing guidance on possible exceptions and complicated guidelines. Routinely evaluating and updating inner plans according to regulative changes will certainly aid companies stay compliant. Promoting an organizational society that prioritizes openness in present acceptance can minimize dangers and enhance liability.

Often Asked Inquiries

What Kinds of Foreign Presents Need Coverage?

Foreign gifts requiring reporting generally consist of considerable monetary payments, building, or benefits obtained from foreign entities, governments, or people, moved here particularly those exceeding details monetary limits set by regulations, demanding transparency to avoid prospective problems of rate discover this of interest.

Are There Fines for Stopping Working to Report an International Gift?

Yes, there are penalties for falling short to report a foreign present. The repercussions can consist of fines, lawsuit, and prospective damages to an individual's or organization's reputation, stressing the importance of compliance with reporting requirements.

Can I Get Legal Help for Foreign Present Reporting Issues?

Lawful help may be offered for individuals dealing with obstacles with foreign gift reporting problems. Qualification frequently depends upon economic need and particular scenarios, prompting prospective receivers to consult regional legal aid companies for aid.

Just How Can I Track Foreign Gifts Got With Time?

To track foreign presents gradually, individuals need to maintain in-depth documents, including amounts, dates, and resources. Regularly using and evaluating monetary declarations tracking software application can boost precision and streamline reporting commitments.

What Documentation Is Needed for International Present Reporting?

Paperwork for foreign present reporting normally consists of the benefactor's details, gift worth, date got, a summary of the gift, and any appropriate correspondence. Precise documents assure compliance with coverage requirements and aid avoid possible legal issues.

Organizations and individuals getting foreign gifts should stick to particular reporting demands to guarantee compliance with lawful obligations. Maneuvering Full Article with the detailed landscape of international gift regulations can be intimidating, especially given the potential legal ramifications of non-compliance. By leveraging legal solutions, customers can browse the ins and outs of international present regulations extra properly, thus decreasing the threat of penalties and cultivating compliance. Legal help might be readily available for people encountering challenges with international present reporting problems. Documents for international present reporting generally includes the donor's info, gift value, date obtained, a summary of the present, and any kind of relevant communication.